Investing in stocks can be a powerful way to build wealth over time. However, the stock market is vast and varied, and selecting the right stocks requires thorough research and analysis. One stock that has recently caught the attention of many investors is Mara Stock, traded under the ticker symbol MARA. This content aims to provide a comprehensive analysis of Mara Stock, covering its company background, financial performance, market trends, and future prospects.

Company Overview

Mara Stock represents Marathon Digital Holdings, Inc., a digital asset technology company engaged primarily in cryptocurrency mining. The company, headquartered in Las Vegas, Nevada, was founded in 2010 and has shifted its focus over the years to become a leader in the cryptocurrency mining space. Marathon Digital Holdings specializes in mining Bitcoin, one of the most widely recognized and traded cryptocurrencies in the world. By leveraging advanced technology and strategic investments, Marathon Digital has positioned itself as a major player in the growing digital currency ecosystem.

Business Model and Operations

Marathon Digital Holdings’ primary business model revolves around the mining of Bitcoin. Cryptocurrency mining involves using high-powered computers to solve complex mathematical problems, which in turn validate transactions on the Bitcoin network. For each problem solved, the miner is rewarded with a certain amount of Bitcoin. As a result, Marathon’s revenue is directly linked to the value and volume of Bitcoin it successfully mines.

To maximize its mining efficiency, Marathon Digital has invested heavily in state-of-the-art mining hardware and infrastructure. The company uses Application-Specific Integrated Circuits (ASICs), which are specialized chips designed for cryptocurrency mining. Additionally, Marathon has made significant strides in optimizing its energy usage, a critical factor in the profitability of mining operations, given the high energy consumption associated with cryptocurrency mining.

Financial Performance

Marathon Digital Holdings has seen substantial growth in recent years, driven by the increasing interest and adoption of Bitcoin and other cryptocurrencies. Here’s a closer look at the company’s recent financial performance:

- Revenue Growth: Marathon’s revenue has experienced exponential growth, reflecting the rise in Bitcoin prices and the company’s expanded mining capacity. In the fiscal year 2023, Marathon reported revenues of approximately $200 million, up from $150 million in the previous year. This growth is largely attributed to the increased hash rate (a measure of computational power) of the company’s mining operations.

- Profitability: Despite the growth in revenue, profitability remains a concern for Marathon Digital Holdings. The company reported a net loss of $50 million in 2023, compared to a net loss of $60 million in 2022. This improvement in net loss is primarily due to increased operational efficiencies and lower costs associated with Bitcoin mining. However, the volatility of Bitcoin prices can significantly impact the company’s profitability.

- Balance Sheet: As of the end of 2023, Marathon had total assets of $500 million, including $150 million in cash and cash equivalents. The company also holds a substantial amount of Bitcoin on its balance sheet, which it mines and retains rather than selling immediately. This strategy allows Marathon to benefit from potential future price appreciation of Bitcoin but also exposes it to the cryptocurrency’s price volatility.

- Debt Levels: Marathon Digital has managed to keep its debt levels relatively low, with long-term debt standing at $30 million. This conservative approach to leverage is beneficial, as it reduces the company’s risk exposure in a highly volatile industry.

Market Trends and Influencing Factors

The performance of Mara Stock is heavily influenced by several key market trends and factors:

- Bitcoin Price Volatility: As a cryptocurrency mining company, Marathon Digital Holdings is directly impacted by the price of Bitcoin. The value of Bitcoin has historically been highly volatile, influenced by market demand, regulatory news, technological developments, and macroeconomic factors. When Bitcoin prices surge, Marathon’s revenue potential increases due to the higher value of mined coins. Conversely, when Bitcoin prices decline, the company’s revenue and stock price may suffer.

- Regulatory Environment: Cryptocurrency regulation is still evolving globally, and changes in regulatory policies can significantly impact Marathon’s operations and profitability. For instance, stringent regulations on cryptocurrency mining in certain countries can lead to increased operational costs or the need to relocate mining facilities. On the other hand, favorable regulations could enhance the company’s growth prospects.

- Technological Advancements: The cryptocurrency mining industry is highly competitive, with rapid technological advancements playing a crucial role in determining a company’s success. Marathon Digital must continuously invest in cutting-edge mining hardware and software to maintain its competitive edge and maximize mining efficiency. Failure to keep pace with technological changes could result in reduced profitability and market share.

- Energy Costs and Sustainability: Bitcoin mining is energy-intensive, and fluctuations in energy prices can have a substantial impact on Marathon’s operating costs. Additionally, there is growing scrutiny regarding the environmental impact of cryptocurrency mining. Marathon Digital has made efforts to address these concerns by exploring renewable energy sources and implementing energy-efficient practices. These initiatives not only help reduce costs but also enhance the company’s reputation and appeal to environmentally conscious investors.

Stock Performance and Investor Sentiment

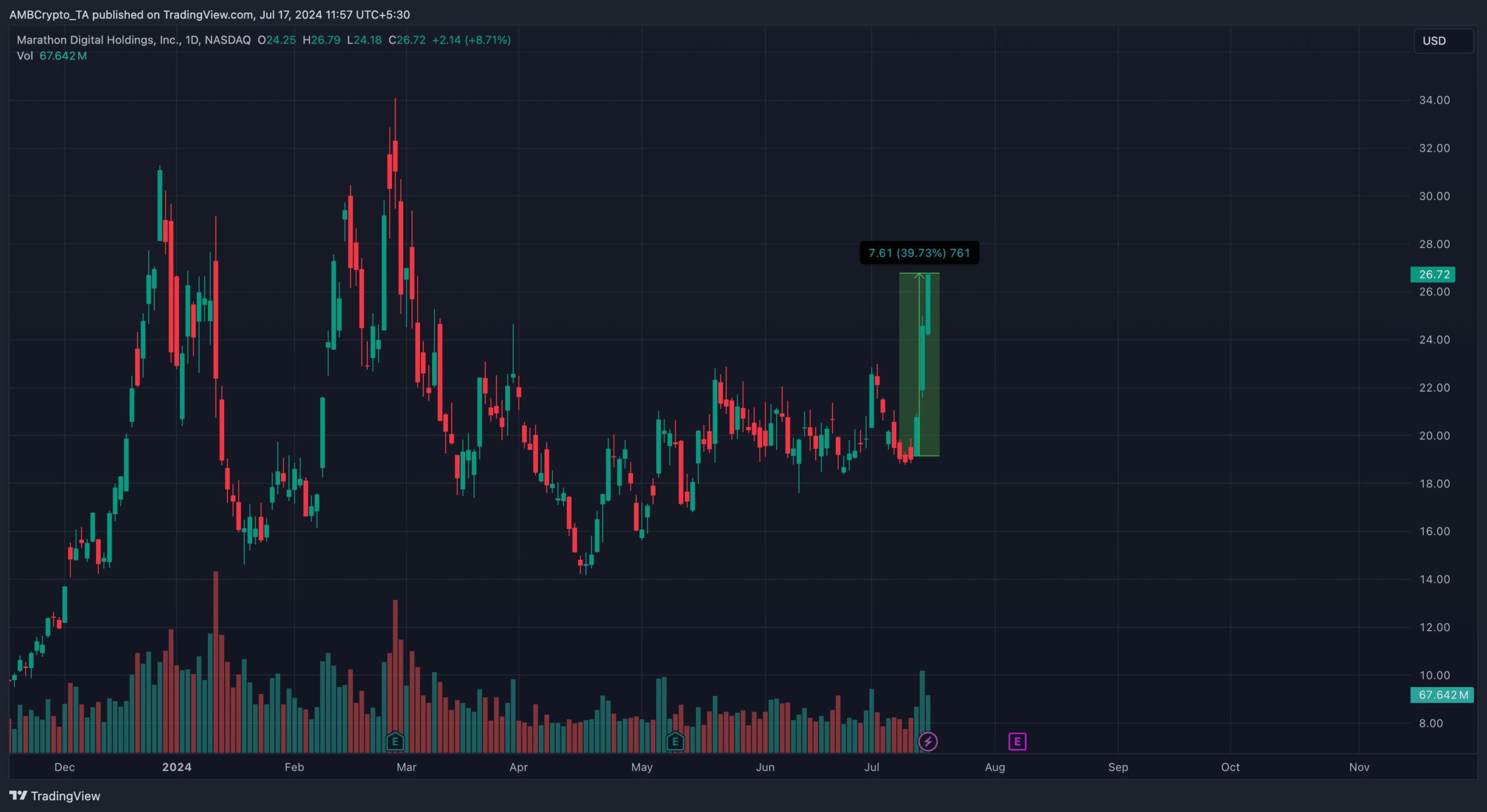

Mara Stock has been characterized by high volatility, reflecting the inherent nature of the cryptocurrency market. Here’s an overview of the stock’s recent performance and investor sentiment:

- Stock Price Movements: Over the past year, Mara Stock has experienced significant price fluctuations, with a 52-week range of $5 to $25 per share. The stock’s performance has closely mirrored the price movements of Bitcoin, demonstrating a strong correlation between the two. Investors in Mara Stock should be prepared for substantial volatility and the potential for rapid price swings.

- Investor Sentiment: Investor sentiment towards Mara Stock is influenced by several factors, including the overall outlook for Bitcoin, regulatory developments, and the company’s financial performance. Many investors view Mara Stock as a high-risk, high-reward investment, given its direct exposure to the volatile cryptocurrency market. While some investors are attracted to the potential for significant gains, others are wary of the risks associated with Bitcoin’s price volatility and the evolving regulatory landscape.

- Institutional and Retail Investors: Both institutional and retail investors have shown interest in Mara Stock. Institutional investors, such as hedge funds and mutual funds, are drawn to the stock’s potential for high returns and its correlation with Bitcoin as a speculative asset. Retail investors, on the other hand, are often attracted to Mara Stock due to its relatively low price and the potential for substantial short-term gains.

Future Prospects and Strategic Initiatives

Marathon Digital Holdings has outlined several strategic initiatives aimed at enhancing its long-term growth prospects and solidifying its position as a leader in the cryptocurrency mining industry:

- Expansion of Mining Operations: Marathon plans to continue expanding its mining operations by increasing its hash rate capacity and optimizing its mining infrastructure. The company has announced plans to deploy additional mining hardware and establish new mining facilities in regions with favorable energy costs and regulatory environments. This expansion will enable Marathon to increase its Bitcoin production and revenue potential.

- Focus on Sustainability: As part of its commitment to sustainability, Marathon Digital is exploring partnerships with renewable energy providers to power its mining operations. By transitioning to cleaner energy sources, Marathon aims to reduce its carbon footprint and address growing environmental concerns associated with cryptocurrency mining. This focus on sustainability could enhance the company’s reputation and appeal to a broader range of investors.

- Diversification of Revenue Streams: While Bitcoin mining remains Marathon’s core business, the company is exploring opportunities to diversify its revenue streams. This includes potential investments in blockchain technology and decentralized finance (DeFi) initiatives. By diversifying its business model, Marathon aims to reduce its dependence on Bitcoin prices and create additional growth opportunities.

- Strategic Partnerships and Acquisitions: Marathon Digital is actively seeking strategic partnerships and acquisition opportunities to accelerate its growth and expand its market presence. These partnerships could involve collaborations with other cryptocurrency mining companies, technology providers, or blockchain projects. Acquisitions could provide Marathon with access to new technologies, talent, and market opportunities, enhancing its competitive position in the industry.

Risks and Considerations for Investors

While Mara Stock offers significant growth potential, it also comes with several risks and considerations that investors should be aware of:

- Cryptocurrency Market Volatility: The value of Mara Stock is heavily tied to the cryptocurrency market, which is known for its high volatility. Investors should be prepared for the possibility of significant price fluctuations and potential losses.

- Regulatory Risks: Changes in the regulatory landscape for cryptocurrencies could have a profound impact on Marathon’s operations and profitability. Investors should monitor regulatory developments closely and consider the potential implications for Mara Stock .

- Technological Risks: The rapidly evolving nature of cryptocurrency mining technology means that Marathon Digital must continually invest in upgrades and improvements. Failure to do so could result in reduced efficiency and profitability.

- Environmental and Social Concerns: As environmental and social considerations become increasingly important to investors, Marathon’s ability to address these concerns through sustainable practices and renewable energy adoption will be crucial for its long-term success.

Conclusion

Mara Stock, representing Marathon Digital Holdings, offers investors exposure to the dynamic and rapidly growing cryptocurrency market. With a strong focus on Bitcoin mining, Marathon has established itself as a key player in the industry. However, the stock’s performance is subject to several risks, including cryptocurrency price volatility, regulatory changes, and technological advancements. As such, investors should carefully consider these factors and conduct thorough research before investing in Mara Stock. By staying informed and understanding the risks and opportunities associated with Mara Stock, investors can make more informed decisions and potentially benefit from the company’s growth prospects in the evolving digital asset landscape.